Types of Medicare Supplement Plans

This article discusses the different options for Medicare Supplement Plans as of 2026. Read on to find out about your options, what they pay, and which plans are the most popular.

Basics About Medicare Supplements

Medicare supplements are sometimes called Medigap plans. We’ll use these terms interchangeably and they mean the same thing. There are 12 different Medicare Supplement Plans available. However all plans have the below in common.

Medigap Plans are guaranteed renewable. That means once you have it, you can keep it as long as you pay the premium. The insurance company cannot cancel you, or charge you more just because of your age, health, or claims.

Medigap Plans (except for Medigap Select Plans) allow you to go to any doctor who accepts Medicare. Since over 95% of doctors accept Medicare this is like having no medical network, and applies across all 50 states. This is a big deal.

Medigap Plans give you easy access to medical care. Generally there are no referrals needed to see specialists or get second opinions. Generally there are no prior authorizations for care or surgeries (except for a few major surgeries).

Supplement Plans are standardized. That means, whichever supplement plan you pick (say plan G) will have the exact same benefits no matter which insurance company you pick. They are truly apples for apples.

Medicare Supplement / Medigap Plan Types

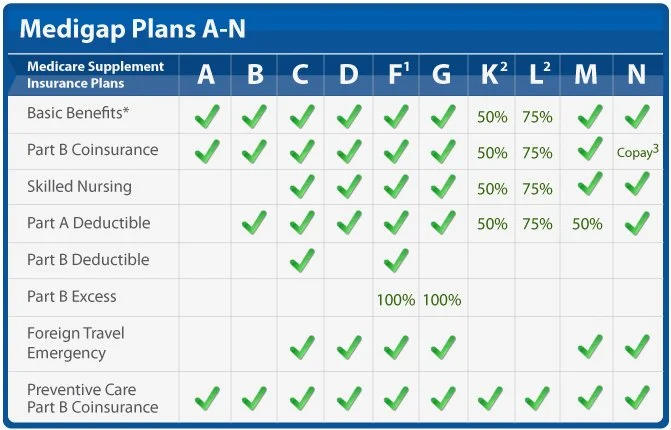

Medicare supplement plans come with different letter names. The chart shows all 12 standardized supplement plans. Each one pays more, or less, of what Medicare Part A and Part B would leave you to pay.

1 - Plan F and Plan C are only available to people that had Medicare before 1-1-2020

2 - Plans K and L have annual out-of-pocket limits. For 2025, that limit is $7,220 for Plan K and $3,610 for Plan L. Once you’ve paid that plus the $257 per year Part B deductible the plan will pay 100% of covered medical expenses.

3 - Plan N has copays for certain services after you’ve paid the $257 per year (in 2025) Part B deductible. These copays are $20 for doctor visits and $50 for ER visits.

Which Plans Are The Most Popular, and What Do They Cover?

While there are many plans you can pick, 90% of policy holders have one of just 3 supplement plans, and 90% of people turning 65 and choosing Medigap plans choose one of just 2 plan options.

Plan G

This is the most popular Medicare Supplement Plan among people turning 65 today. The benefits for Plan G are simple and easy to understand. Plan G pays 100% of Medicare covered services after you’ve paid the Part B deductible ($257 per year in 2025). Plan G includes a $50,000 emergency benefit when out of the country.

According research group Mark Farrah & Associates, as of 2024, 42.5% of existing Medigap policy holders have Plan G, and among people just turning 65 and choosing Medigap, over 55% chose Plan G.

Plan N

This is the second most popular Medigap plan being purchased today. The benefits are similar to Plan G, in that Plan N pays 100% of Medicare covered services after you have paid the Part B deductible ($257 in 2025) except you will also pay $20 copays for doctor visits, $50 copays for ER visits, and Medicare excess charges if your doctor charges these (most don’t).

The idea with Plan N is that you’ll have excellent coverage for the major services, 100% for hospital stays, surgeries, and chemotherapy after the deductible, and affordable copays for common services. We like Plan N as it is often $30-$50 per month less expensive than Plan G for similar coverage.

According research group Mark Farrah & Associates, as of 2024, 10.4% of existing Medigap policy holders have Plan N. Among people turning 65 and choosing Medigap plans, nearly 40% of enrollments are for Plan N.

Plan F

This is a popular plan among older Medicare beneficiaries. It was the most popular supplement plan some years ago, but it is no longer offered for people who got onto Medicare after 1-1-2020. Plan F pays 100% of Medicare covered services and includes a $50,000 per year emergency travel benefit. It is the most expensive plan option.

According research group Mark Farrah & Associates, as of 2024, 33.1% of existing Medigap policy holders have Plan F, but this number is shrinking since few new people can purchase this option.